As an employer offering share schemes or equity-based incentives to your employees, it’s crucial to comply with HMRC’s reporting requirements for Employment Related Securities (ERS). Failure to submit accurate and timely ERS returns can result in significant penalties and potential loss of tax advantages. In this blog post, we’ll provide an overview of ERS returns, when they’re required, and how to ensure compliance.

What is an ERS return?

An ERS return is an annual online filing that employers must submit to HMRC, reporting any transactions involving employment-related securities, such as shares, share options, or other equity-based incentives granted to employees or directors. This includes tax-advantaged schemes like Enterprise Management Incentives (EMI), Company Share Option Plans (CSOP), Save As You Earn (SAYE), and Share Incentive Plans (SIP), as well as unapproved arrangements.

When is an ERS return required?

Employers must submit an ERS return by 6 July following the end of the tax year (which runs from 6 April to 5 April the next year) for all open share schemes, even if there were no transactions during that period. This means that a nil return must be filed if no reportable events occurred. Reportable events include, but are not limited to:

- Granting, exercising, cancelling, or replacing share options

- Awarding shares, restricted stock units, or other securities

- Lifting restrictions on shares

- Changes in the value of an employee’s or director’s shareholding due to actions like substantial movements in loans to or from a related company

Penalties for non-compliance

Failing to submit an ERS return by the 6 July deadline or submitting an incorrect return can result in significant penalties from HMRC:

- An automatic £100 penalty for late filing, even if it’s just one day late

- Additional penalties of £300 if the return is still outstanding after three months and another £300 after six months

- Daily penalties of £10 per day if the return is still outstanding after nine months

It’s important to note that late certification for tax-advantaged share plans can also lead to the loss of tax advantages for certain awards.

Checking for Open Share Schemes

To ensure you don’t miss any open share schemes that require an ERS return, you can check your HMRC PAYE for Employers account online. Here’s how:

- Log in to your PAYE for Employers account on the Government Gateway using your user ID and password. If you do not have an account, you can register here.

- Via the “PAYE for Employers” section, navigate to the Employment Related Securities (ERS) section.

Once here, your screen should look like this:

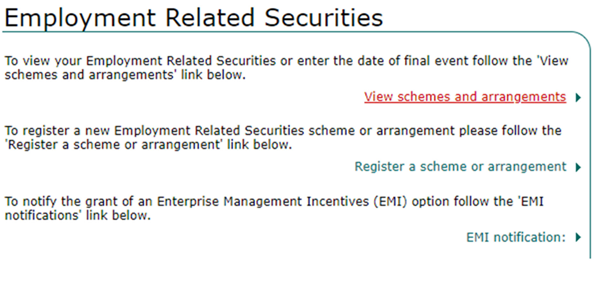

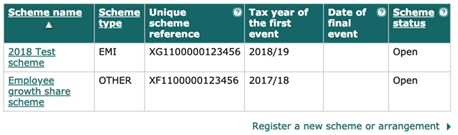

- You then need to select “View schemes and arrangements”. Review the list of registered share schemes and their status (open or closed).

- If you have any open schemes, you’ll need to submit an ERS return for each one by 6 July, even if there were no transactions during the tax year.

By staying on top of your ERS reporting obligations and submitting accurate and timely returns, you can avoid costly penalties and maintain compliance with HMRC regulations.

At BHP, we understand the complexities of share scheme reporting and can assist you throughout the process, from identifying reportable events to preparing and submitting your ERS returns. Contact our expert Tax team today to ensure your business remains compliant and avoids any unnecessary penalties.

This material is for informational purposes only and should not be relied upon as professional advice.